On Budget Day 2024, the Cabinet presented the Tax Plan 2025. This article discusses the main legislative changes affecting income tax.

Box 1

Change in tax rates

Rates in Box 1 will be changed as follows, reintroducing a separate third rate bracket.

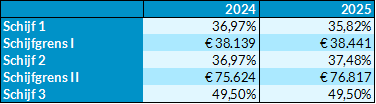

Taxpayers under the state pension age:

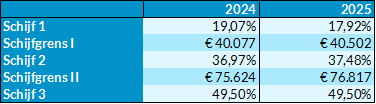

Taxpayers who have reached state pension age:

Tax credits

The general tax credit will be reduced by €335. The rebate will amount to a maximum of € 3,068 (2024: € 3,362). From 2025, the reduction of the general tax credit will depend on the aggregate income, box 1, 2 and 3 together, instead of only the box 1 income. From 2025, therefore, box 2 benefits (such as dividend payments) and the benefit from savings and investments will also affect the obtainable general tax credit.

The earned income tax credit, which depends on box 1 income, will increase in 2025 to a maximum of €5,599. It was €5,532 in 2024.

IB entrepreneur: reduction in self-employment deduction and SME profit exemption

The self-employment deduction continues to be phased out. In 2024, the self-employment deduction was €3,750. In 2025, the self-employment deduction will be €2,470.

The SME profit exemption is also going down again. In 2025, this deduction will be 12.7% where it was 13.31% in 2024.

Box 2

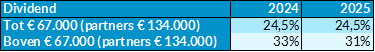

The additional rate increase in the second bracket in Box 2 will be reversed. The rate in the second bracket will be reduced from 33% to 31%. The rate in the first bracket will remain at 24.5%.

Box 3

The Tax Plan contains no changes regarding Box 3. The tax rate remains at 36%. The Tax Plan also does not address the restoration of rights box 3 and/or the future of this legislation. For more information on these topics, please see our previous news releases.

In conclusion

Do you have questions about the changes or are you curious about the possibilities in your specific situation? Feel free to contact us via the contact form below or with your own Govers contact person.