Govers works from the heart of the Brainport. Our innovation region with a lot of manufacturing industry is characterized by a strong high-tech character where cooperation is central. Themes such as digitalization, Industrie 4.0, circular production, chain optimization, cost control and achieving sustainability goals are the order of the day.

Govers: your strategic partner for growth and innovation in the manufacturing industry

Govers is more than a financial advisor. As a strategic partner, we help companies in the manufacturing industry and in the supply chain to the OEM navigate the complex landscape of technology, sustainability and globalization. Our focus is on improving the efficiency of your processes, leveraging innovations, managing risk and achieving financial optimization.

Timely and accurate records provide insight into both financial opportunities and challenges. It enables you to make timely adjustments where necessary. We support you in (monthly) closing the administration, preparing (monthly) reports and dashboarding. We also help define and monitor relevant key figures for inventory management, accounts receivable management and the development of cash flow and results.

We support you not only in complying with laws and regulations, but also in anticipating future trends and creating sustainable value. In a world where the manufacturing industry is constantly evolving, we help you grow and innovate so that you are ready for the future.

Our themes

Innovation and digitization

Technological advances offer countless opportunities for the manufacturing industry, from automation and robotization to 3D printing and the Internet of Things. Digitalization enables companies to optimize production processes, reduce downtime due to breakdowns or maintenance, and increase productivity. Therefore, topics such as digital twin technology, maintenance forecasting and the use of big data and AI in production are becoming increasingly important.

Investing in technology is necessary to stay relevant. This involves many questions where we see a natural advisory role for ourselves, such as:

- How long does it take for outgoing cash flow from investments to be offset by income from sales?

- How will the negative cash flow be financed?

- What are the investment choices and are they eligible?

- What securities are required?

- As an entrepreneur, to what extent can you maintain your autonomy?

Sustainability and circular production

The pressure to become more sustainable is increasing, both from regulations and from society. The manufacturing industry is challenged to embrace circular production methods. To reuse raw materials and minimize waste. Sustainable product development and the integration of green energy into the production process are key components of this transition.

We can help you with sustainability reporting and demand from the chain. We can also assist in developing sustainable business models and taking advantage of tax benefits of sustainable investments, such as the Energy Investment Allowance (EIA) and Environmental Investment Allowance (MIA).

Efficiency and cost control

In a competitive market, it is essential to manage your production processes efficiently. This means constantly looking for cost-saving opportunities, both in the primary production process and in supporting functions. Here, lean manufacturing plays an important role, as does optimizing the supply chain to eliminate waste and reduce lead time.

Our specialists give you insight into the financial management of production processes and support you in identifying inefficiencies. We also advise on optimizing cash flow and working capital, and help analyze your cost prices. Here, materials, man hours, machine hourly rates and the coverage used are crucial. We give you insight into whether your pre-calculations are representative to arrive at a sales price with a healthy profit margin.

Chain optimization and risk management

Recent disruptions in global supply chains exposed the vulnerability of many manufacturing companies. Managing supplier relationships, assessing risks and ensuring supply chain continuity are crucial. This requires accurate financial planning and timely identification of risks that could disrupt production, such as raw material price fluctuations or logistical problems.

With a liquidity forecast, we provide insight into your future liquidity position so you can anticipate potential risks early. This can help in the implementation of your investment plan, your financing request or in shortening the cash cycle, from payment to suppliers to receipt of payment by the customer.

Taxation in the manufacturing industry: smart tax strategies

Taxation in the manufacturing industry: smart tax strategies

The tax situation in the manufacturing industry is complex and presents both challenges and opportunities. You can benefit from various tax breaks, such as depreciation on investments in machinery, equipment and technological innovations. The Energy Investment Allowance (EIA) and Environmental Investment Allowance schemes can also encourage you to invest in sustainable technologies.

You should also be aware of the tax issues involved in internationalization, such as the VAT reverse charge mechanism for cross-border supplies and making the most of tax rates in different countries. If your company is technically innovating and developing a new product, service or process innovation, you can benefit from WBSO for in-house R&D employees. Under certain conditions, you can take advantage of the innovation box, which allows you to make substantial corporate tax savings on innovative profits.

We not only help you make the best use of tax schemes, but also offer strategic support in structuring your international tax position, restructuring business models and developing tax optimization strategies.

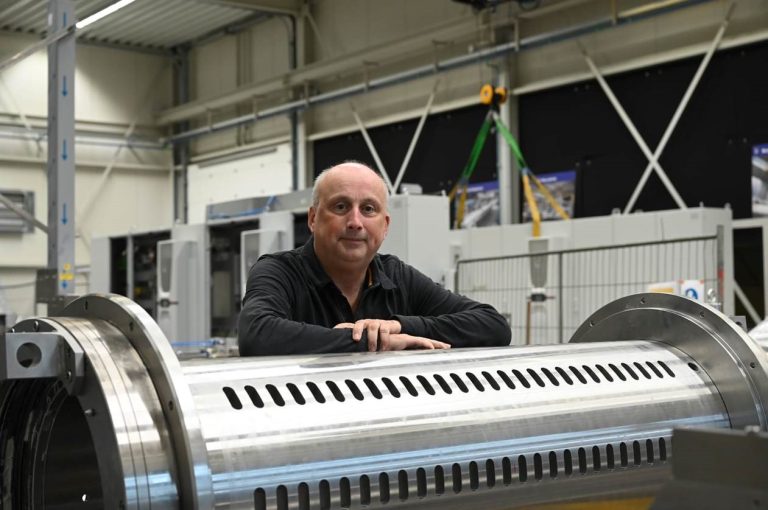

"As an entrepreneur, you always have worries, but on the financial front, peace prevails from now on."

Sanders Machinebouw invents and builds unique machines

When the company passed from the Sanders family to Stefan van den Nieuwenhof six years ago, it was time for a new accounting firm. "We really wanted to make strides with the acquisition," Van den Nieuwenhof says. "And we succeeded with the choice of Govers!"

Govers oversaw Van den Nieuwenhof's acquisition from start to finish, both in terms of business and private life. "Until then, my wife and I just shared everything old-fashionedly by two. But with a business of our own, that's not necessarily the best option. So Govers talked not only to the Sanders family and myself, but also to my wife. And we all received good advice on how best to deal with the new situation. Incredibly valuable, because while I may know about machinery; for financial legal matters you really need a specialist "